Bay Area Housing Market: Prices, Trends, Forecast 2022-2023

Will the Bay Area Housing Prices Drop?

This page has been updated to reflect the most recent trends in the Bay Area housing market. Even though homes in the Bay Area housing market continue to sell for record prices, the market is leveling out. According to C.A.R., home sales in California plummeted by 47.7 percent in November 2022 compared to the same month last year. It was the lowest annualized pace since October 2007.

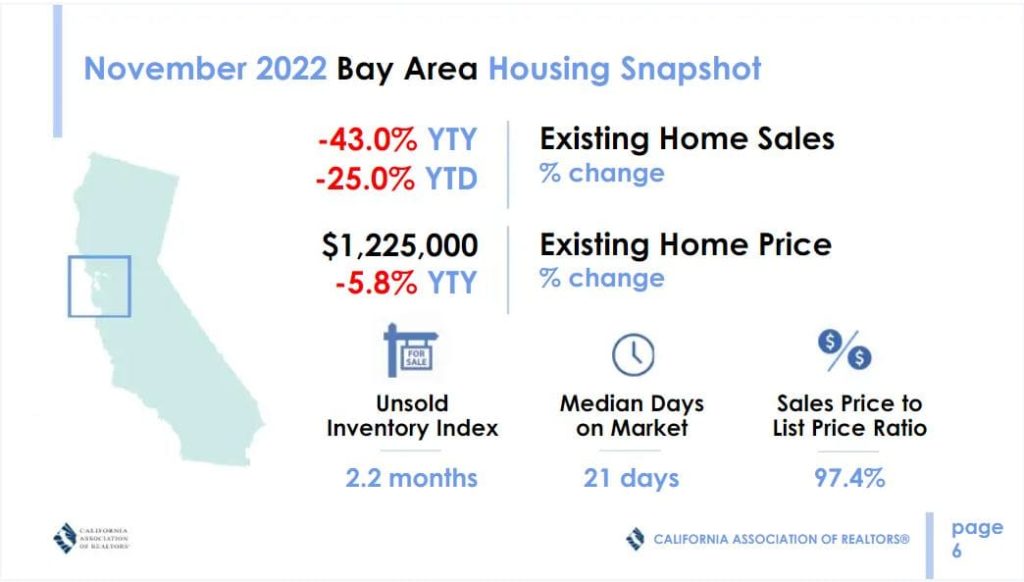

In the Bay Area, home sales declined by 43.0 percent. Not only that but sales in five of the nine counties in the Bay Area fell more than 40 percent in November, with Santa Clara plunging the most by 47.0%. These trends show that the Bay Area housing market continues to decelerate from the frenetic levels of the last two years, offering advantageous conditions for purchasers who lost bids or waited out the intensely competitive market. The huge decline in sales occurs as mortgage rates increase, discouraging purchasers.

The interest rates are beginning to affect prospective buyers hoping to enter the market. There is slightly more inventory, which is a positive development because the inventory is still low. But the more inventory there is, the less competitive the housing market will become for buyers. The cost of purchasing a property in the Bay Area has not yet decreased significantly. The median sales price in Bay Area topped $1 million for the 21st month in a row.

The median sale price for a Bay Area home last month was $1,225,000, which is 2.0% less than October’s price of $1,250,000. The price also dropped by 5.8% year-over-year, when the price was $1,300,000. It is the price in the very middle of a data set, with exactly half of the houses priced for less and half-priced for more in the Bay Area real estate market. It shows that the Bay Area housing market is distinguished by high demand and a scarcity of available inventory. Due to persistent demand from the state’s high-income residents, home prices have skyrocketed in this market over the past few years.

Bay Area Real Estate Market Trends for November 2022

Source: CAR

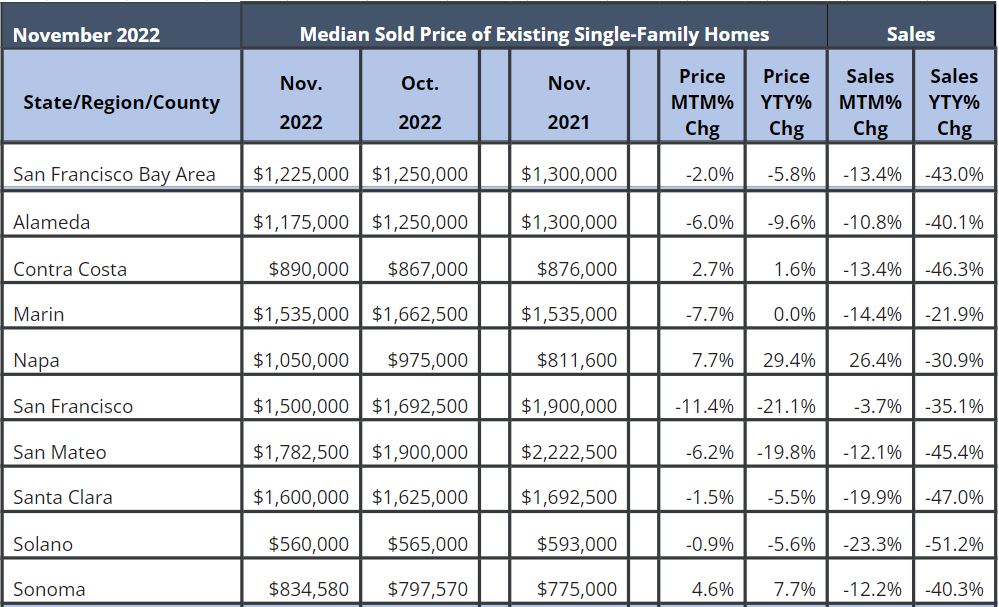

The housing prices in Bay Area dropped in November 2022. According to current trends, housing prices in the majority of Bay Area communities will decline over the next twelve months. Zillow projects a decline of 6.1% in Bay Area home prices between November 2022 to November 2023. The median sales price of this region, which includes all nine counties of Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma, is $1,225,000.

According to C.A.R., this is a 5.8 percent drop over the last year’s November. Sales of existing homes were down in all the major regions of the California housing market. Southern California had the sharpest decline of all regions, with sales dropping -46.9 percent from a year ago. The San Francisco Bay Area (-43.0 percent) had the third-largest drop of all regions after the Central Coast (-43.5 percent).

The housing inventory in the Bay Area is low but increasing. As of November 2022, the months of supply for existing single-family houses in the Bay Area is 2.2 months, an increase from last year when it was 1.0 months. Homes are selling below the asking price (on average). Sales Price to List Price Ratio = 97.4%, a significant drop from the last November when it was 105.7%.

Only those who do not have enough money for a down payment are delaying their purchases. Looking at the low supply of homes, high-interest rates, interested buyers may have a difficult time finding available properties in the Bay Area. Hence, sales and prices are expected to decline in 2023.

Data by CAR. Forecast by Zillow (Nov 2022)

Below is the latest tabulated housing market report for the entire Bay Area released by the California Association of Realtors. The tabulated report shows the sales and prices of the Bay Area counties for November 2022. Much of the Bay Area real estate market remains in “seller’s market” territory with months of supply of available single-family homes being about 2.2 months at the current pace of sales.

Source: CAR.org

Bay Area Housing Market Forecast 2022 & 2023

Bay Area consistently ranks among the world’s most expensive real estate markets, and it is one of the most densely populated cities in the U.S. The Bay Area housing market consists of all nine counties (Alameda, Contra Costa, Marin, Napa, San Francisco, San Mateo, Santa Clara, Solano, and Sonoma) and 101 municipalities. The region is home to three major cities: San Francisco, Oakland, and, the largest, San Jose. Here are Bay real estate market predictions for 2023.

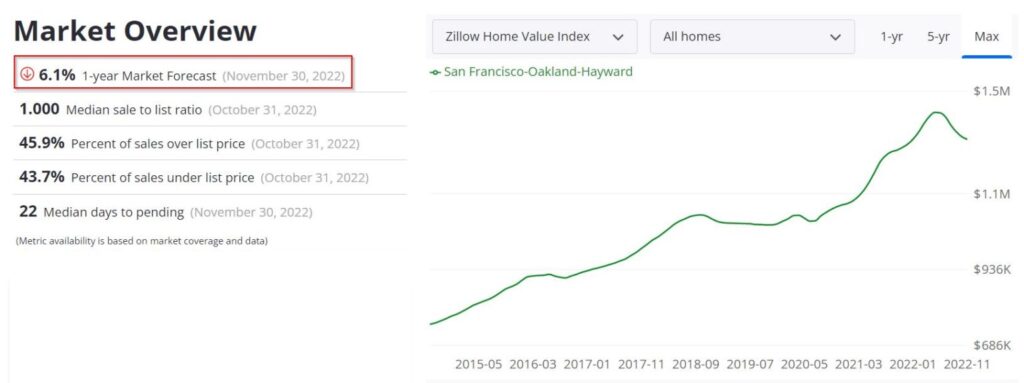

San Francisco-Oakland-Hayward Metro (Bay Area) Forecast up to November 2023

The typical value of homes in the San Francisco-Oakland-Hayward Metro (Bay Area) is $1,374,028, up 2.0% over the past year. Here are Zillow’s latest home price projections for the Bay Area and its counties. Higher mortgage rates are playing an important role in the moderation of price growth. Bay Area (San Francisco-Oakland-Hayward Metro) home values have gone up over the past year but they are expected to decline by 6.1% from Nov 2022 to Nov 2023 (ZHVI).

- Typical Home Values: $1,374,028 (Oct 31, 2022)

- 1-year Value Change: +2.0%

- 1-year Value Forecast: -6.1%

- 22 Median days to pending

- 1.000 Median sale-to-list ratio (October 2022)

- 45.9% Percent of sales over list price (October 2022)

- 43.7% Percent of sales under list price (October 2022)

Here is the graphical representation of historical home prices since the last decade.

Source: Zillow

SF Bay Area Real Estate Investment Overview

Should you consider San Francisco real estate investment? Many real estate investors have asked themselves if buying a property in San Francisco is a good investment as the median price for a two-bedroom sits at $1.35 million. The high cost of real estate in San Francisco is impossible for most families to manage. Exodus is yet another problem and a new report confirms that the numbers are staggering. Online real estate company Zillow released new statistics shining a stark light on the issue this week.

Their “2020 Urban-Suburban Market Report” reveals that inventory has risen a whopping 96% year on year, as empty homes in the city flood the market like nowhere else in the country. Although this article alone is not a comprehensive source to make a final investment decision for San Francisco, we have collected some evidence-based positive things for those who are keen to invest in the San Francisco real estate market. If you can afford it, then it’s an investment that will continue to increase in value over time.

Due to low-interest rates in 2021, there was an influx of high-end luxury buyers, with certain instances where homes have been sold for $1 million over asking. Let’s talk a bit about San Francisco and the surrounding bay area before we discuss what lies ahead for investors and homebuyers. San Francisco is home to nearly 900,000 people. It is the hub of the San Jose-San Francisco-Oakland area; this larger metro area is home to nearly nine million people.

The city alternately makes the news for people paying incredibly high rents to live in boxes, the homeless problem, and the tech industry. This makes many think about why or how anyone could live there. Others would think why you’d want to buy a property now in such an overvalued real estate market. Yet we can give you ten positive signs about the San Francisco housing market. Keep on reading to find out more. Why is housing so expensive in San Francisco?

First of all, the entire state of California has a consistent housing shortage due to limited land. Most of the cities including San Francisco are failing to meet the regional housing needs. New construction permits in all cities often lag due to community resistance which blocks new housing. Jobs are increasing and the economy is the strongest in 50 years. But due to the tight supply of homes, San Francisco home prices have grown much faster than incomes.

The minimum annual income required for owning a house in the San Francisco bay area in 2019 was $197,970. That’s an increase of 119.1% since 2012 when affordability was at its peak. Homeownership is not rebounding anytime soon in San Francisco. By 2025 more than 60% of the population is estimated to rent. Housing affordability has been a consistent issue for first-time buyers over the last few years. They have limited options in the San Francisco housing market.

Although mortgage rates have decreased, big down payments & all-time high home prices aren’t spurring more sales. Many simply can’t afford to buy a house due to these factors. Despite Covid-19, in the latest quarter, the San Francisco real estate appreciation rate has been around 0.21%, which amounts to an annual rate of 0.84%. Some experts feel that home prices may drop by 1 to 2% in the next twelve months.

This is a good sign for new homebuyers and investors as far as affordability is concerned as many of them can’t afford to buy a median-priced home in San Francisco. We shall discuss some more important reasons why you may want to consider buying San Francisco investment properties for the long-term buy and hold.

Bay Area’s Strong Economy Propels Real Estate

Why doesn’t everyone just move out of the San Francisco housing market? Some do move, but they have a one-and-a-half to two-hour commute each way to work because they still want to work there. They just can’t afford to live there. Moreover, it is the high-tech job market that draws so many people to San Francisco and leaves many others struggling to pay the bills. San Francisco is turning into a major international city. It is a white-collar city, with fully 90.74% of the workforce employed in white-collar jobs, well above the national average.

In a report published by Google in June 2019, it announced one billion dollars of investment in housing across the Bay Area. A 10-year plan to add thousands of homes to the Bay Area. The company would be making this major investment in what it believes is the most important social issue in the bay area real estate market.

This proposition by Google will add thousands of new homes to the Bay Area real estate market over the next ten years. About $750 million would be used for repurposing Google’s own commercial real estate for residential purposes. This will allow for 15,000 new homes at all income levels in the Bay area. Another $250 million investment fund would be utilized to provide incentives to enable developers to build at least 5,000 affordable housing units across the Bay area housing market.

As a move to support affordable housing initiatives, these investments will help Google plans to give $50 million in grants through Google.org to nonprofits focused on the issues of homelessness and displacement of citizens. The company also plans to fund community spaces that provide free access to co-working areas for nonprofits, improve transit options for the community, and support programs for career development, education, and local businesses.

As it is the epicenter of the technology industry, there are a lot of people with an immense amount of wealth. Wealth isn’t just limited to the uber-wealthy founders of major tech companies or successful VCs but also the general workforce, whose salaries and incomes are among the highest in the world. Overall, San Francisco is a city of professionals, managers, and sales and office workers. Also of interest is that San Francisco has more people living here who work in computers and math than 95% of the places in the US.

The predicted 2020 job market slowdown won’t result in layoffs, just a drop in job growth to 1.5 to 2 percent a year. Note that the area already has an unemployment rate of 1.2 percent below the national average. The unemployment rate in the San Francisco-Redwood City-South San Francisco MD was 1.8 percent in December 2019, down from a revised 1.9 percent in November 2019, and below the year-ago estimate of 2.1 percent.

This compares with an unadjusted unemployment rate of 3.7 percent for California and 3.4 percent for the nation during the same period. An upcoming recession is likely to have a limited effect on the SF Bay Area’s housing market. It will only temper housing price appreciation but not reduce it. These solid economic fundamentals are integral to maintaining high rental property demand and ensuring a good return on investment.

San Francisco Rental Market

You may read about the growth of Portland and other Pacific Northwest cities as talent and businesses flee the expensive San Francisco real estate market. That’s hardly impacted the San Francisco housing market, though. However, San Francisco has several advantages over its Oregon rivals, and that’s the fact that you aren’t in Oregon. Oregon passed a state-wide rent control law in 2019. This is in addition to many city regulations regarding affordable housing. In Oregon, your ability to raise rents is limited by the state.

Making matters worse, there are many more renters than property owners, so they’ll tighten the allowable rental increases and continue to hamper owners until they’re losing money. And then there is California. You can find a variety of rent control laws in the San Francisco housing market because every city takes its approach to the problem. This means that you can find suburban San Francisco rental properties where you could raise rental rates to match the market. Furthermore, rent control laws typically don’t apply to newer single-family homes.

California, on the whole, is unfriendly to landlords. It is challenging to evict people. It can take a long time to evict someone who occasionally pays the rent. Taxes are high. What does this do to the San Francisco housing market? It leaves open the possibility that you could snap up San Francisco rental properties at a relatively bargain price by people who just want to quit, whether they want to sell the properties or leave the state. For example, the laws governing the San Francisco real estate market allow you to buy San Francisco rental properties and evict the tenants to turn the units into condos for sale.

SF Rental Statistics

San Francisco holds the position of the priciest rental market. It is still #1 among the top 5 rental markets in the nation. The average rental income for traditional San Francisco investment properties is well above the national average. Like most of the Bay Area, the percentage of people renting in San Francisco is more than the owners. San Francisco has around 56 percent of its residents living in rental homes.

If condo prices are going to drop or remain flat in 2023, people will see a good investment opportunity. They’ll be able to get in at a good price and there will be an increase in demand. If you’re in the market for a condo in San Francisco, that means you could get a great deal. According to several rent reports (discussed above), rental price declines have hit the bottom and are almost flat as compared to the previous month.

San Francisco’s Geography & Zoning Restrictions Limits inventory

San Francisco real estate market is perpetually constrained in terms of inventory. Several factors contribute to this, but principally the strict zoning laws prevent new development and high-rise construction throughout the city. The strict zoning laws, coupled with the fact that the SF is only seven by seven miles, make it a very constrained market and keep supply perpetually low. San Francisco sits on a peninsula, surrounded on three sides by water.

They cannot build to meet housing demand. The surrounding cities are densely built up, as well. The only way the San Francisco real estate market could meet demand is by ripping out large swaths of two and three-story buildings to build condo towers, but that’s almost impossible given local regulations. The ability to build up is limited in the surrounding suburbs because of the mountains.

The San Francisco real estate market is, for better or for worse, beholden to several competing interest groups. For those with money that own their homes and have the most influence, “not in my backyard” or NIMBY means that voters fight any proposal to replace a 2 or 3-story warehouse with a 20-story apartment or condo building. They want to protect the look and feel of the community, and through high-rise construction could start to relieve the overcrowding in the San Francisco real estate market.

The horrific stories of developers going through four years of red tape to build multi-family San Francisco rental properties deter others from even trying. Ironically, this creates significant returns for those who buy up San Francisco rental properties and can convert them to multi-family housing.

San Francisco’s Environmental Movement

The environmentalist movement and California are intertwined in the public’s mind and for good reason. This is the best demonstration of its impact in Marin County. An estimated 85 percent of the county is off-limits to development. This doesn’t mean there are no homes here. It means that there are large estates that cannot be turned into tract homes. Neighbors fight any such project. This is why George Lucas had to threaten to build hundreds of homes on Skywalker Ranch when they wouldn’t let him expand his studios there. This also explains why the San Francisco real estate market cannot solve its affordable housing crisis by building in relatively open lands in Marin County.

Warehouses and factories have been converted to lofts in large, established cities around the world. They offer open spaces, high ceilings, and proximity to public transit and downtown amenities. San Francisco is no exception to this trend. The difference is the growth in high-density San Francisco rental properties which can only be found in co-living spaces. These can be considered high-end dorms.

People may rent a bunk bed and storage space for their possessions, gaining access to laundry, kitchens, and workout facilities. Several people may share a bedroom that rivals a cramped college dorm room. These facilities are booming because they cater to the new college graduates already used to living this way and willing to continue to do so to work for Big Tech firms in San Francisco.

San Francisco’s Luxury Real Estate Market is Booming Despite Pandemic

Dealing in the luxury real estate market has its benefits. More affluent buyers are the demographic least affected by any economic crisis such as brought up by the Covid-19 pandemic as they have the greatest financial resources. Although home prices soaring there is an influx of wealthy buyers. A relatively high percentage of the buyers in the city are all cash (Around 40 to 60 percent of them). Those that aren’t paying all cash are putting at least 20 percent down with the ability to close fast, even with a loan.

In June, house values in California city reached a record monthly high of $1.8 million. Deep-pocketed home buyers across San Francisco bolstered the market’s rebound and pushed up transactions and house prices, according to a report Monday from Compass. The number of luxury single-family homes—defined by the report as those priced at $3 million and above—that accepted an offer in June surpassed 30, the highest level the metric has reached in two years, data from the brokerage showed.

The increase helped push San Francisco house values to a record monthly high of $1.8 million in June, 3% higher than the previous peak of $1.75 million in June 2019. You will find first-time homebuyers who are buying over $2.5 million or baby boomers looking for second homes in the $2 million range. New units are being built in the San Francisco housing market. However, the reality is that the pool of people who can afford to buy is smaller and smaller and the supply of housing is not growing with demand. They mostly consist of luxury condos and mega-mansions built for the elite of the Big Tech workforce.

Another unintended side effect of regulations on San Francisco rental properties is that it incentivizes the construction of high-end units. Investors could invest in these projects or buy properties in the hopes that they are torn down and redeveloped. This is why burned-out husks can sell for hundreds of thousands of dollars and ones with demolition permits can sell for a million or more.

San Francisco’s Real Estate Appreciation Rate is High

Thanks to all the factors discussed above, the entire bay area has one of the highest appreciation rates. A major reason San Francisco’s housing prices have climbed so high over the past decade is the city’s vibrant tech industry, which started booming in 2012 (thanks, in part, to a tax incentive aimed at attracting tech companies to the city over Silicon Valley). It now attracts a skilled workforce to the city while also driving up the demand for housing and the cost of living.

The data from NeighborhoodScout reveals that San Francisco real estate appreciated 111.65% over the last ten years, which is an average annual home appreciation rate of 7.79%. This figure puts San Francisco in the top 20% nationally for real estate appreciation. And within San Francisco, some individual neighborhoods’ home values have jumped by more than 100%. Here are the five San Francisco neighborhoods that have had the biggest jump.

- Bayview: Bayview had a $424,900 median home value in April 2009, which went to $1.07 million in Jan 2020. The current value is $1,030,643 (Zillow Home Value Index as of October 2022).

- The Forest Knolls: In April 2009, this neighborhood’s median home value was $811,800, and it topped $1.8 million in Aug 2018. The current value is $1,874,448, up 0.3% YTY.

- Bernal Heights: This neighborhood went from a median home value of $715,000 in April 2009 to $1.66 million in Aug 2018. The current value is $1,565,485, a drop of 6.4% YTY.

- Mission: This East of The Castro neighborhood is in central San Francisco. The median home value was $699,900 in April 2009 and $1.53 million in Dec 2019. The current value is $1,332,707, down 5.3% YTY.

- Potrero Hill: This neighborhood lies in the East of the Mission District. It has a median home value of $734,200 in April 2009 and it topped $1.59 million in Sep 2020. The current value is $1,376,919, down 8.2% YTY.

The good news is that if you are a home buyer or real estate investor, San Francisco has a track record of being one of the best long-term real estate investments in the nation over the last ten years. So if you bought a home in San Francisco 10 years ago, it’s very likely you’d have profited on the deal by now — in fact, in several neighborhoods, you would have a good chance at doubling your money. All the variables that contribute to real estate appreciation continue to trend upward which makes investing in SF real estate a sound decision.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in San Francisco.

Consult with one of the investment counselors who can help build you a custom portfolio of San Francisco turnkey investment properties in some of the best neighborhoods. All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete San Francisco turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

Recent Posts

- Bay Area Housing Market: Prices, Trends, Forecast 2022-2023 December 19, 2022

- The Roots of Appreciation December 19, 2022

Categories

- Uncategorized (2)